GradGuard’s tuition insurance first and only program to cover COVID-19 and mental health conditions nationwide; provides financial safety net when schools don’t

PHOENIX (August 10, 2021): Nationwide, college families are once again finding themselves evaluating the ever-changing updates on how schools will protect students from Coronavirus as the Delta variant becomes a growing concern. As parents prepare to pay their final tuition bill before arriving on campus, among the many questions they are smart to ask is: What will happen to my tuition payment if my student is forced to withdraw from college due to becoming ill with COVID or other illnesses and unable to continue their term?

For many families, college is one of the largest investments they will ever make. As a result, it’s a smart move for anyone paying tuition to understand their school’s refund policy and to consider protecting their investment with tuition insurance.

“The thousands of dollars students and families are paying for college tuition, housing and academic fees are often at risk,” said John Fees, parent of a college student and the co-founder of GradGuard, one of the largest providers of student insurance programs in the country with partnerships at more than 400 colleges and universities. “The idea of losing money can create even more financial stress for students and their parents. GradGuard enables students and families to make the decision on whether to withdraw is based on the well-being of their student and not just the money at risk.”

The coronavirus pandemic and its surging Delta variant has brought important attention to the risk of investing in college and particularly, how schools manage refunds.

While neither schools or tuition insurance provide refunds for a change in the form of instruction (such as the move to online classes), families may be surprised that they will likely lose thousands of dollars if their student’s semester is disrupted by a health event and forced to withdraw.

In fact, only 6% of schools surveyed in 2019 provided 100% refunds for tuition and virtually none provide refunds for academic fees or housing. Many universities may refund a portion of tuition through the first few weeks of school, but most schools will not provide a refund after the fifth week of classes. Academic fees, deposits and housing are usually not eligible for a refund.

The risk can often surprise college parents. Less than a quarter of parents surveyed in a 2019 College Parents of America report indicated that their student’s college refund policy was disclosed to them during the enrollment process.

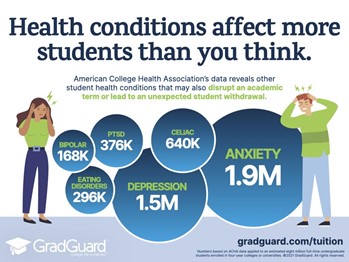

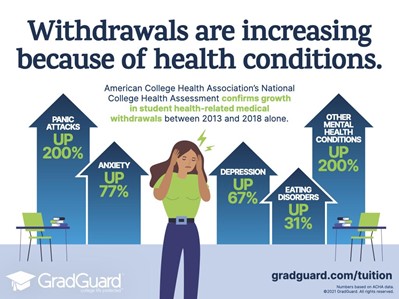

Families are also often unaware that their college student may be vulnerable to the stress of college life. The National College Health Assessment produced by the American College Health Association demonstrates the frequency of incidents such as illnesses, accidents, and injuries that can require a student to complete a medical withdrawal. This data also reveals a growth in chronic illnesses and rapid growth in serious mental health incidents during the past five years.

“If a student has a controlled pre-existing condition like serious anxiety or mental health conditions, and they are medically cleared to attend school, GradGuard’s tuition insurance can cover them,” said Fees. “If they must withdraw under the recommendation of a licensed professional in their state, tuition insurance can reimburse the out of pocket costs associated with their housing, tuition, and student fees . GradGuard’s tuition insurance can help reduce the stress students face in these situations and help everyone focus on the well-being of the student.”

It’s important for families to note that even prior to COVID-19, student health conditions force thousands of students to withdraw from classes each year, without the ability to recover the thousands of dollars paid for classes, fees and housing.

The Top Three Reasons GradGuard’s Tuition Insurance Is A Smart Decision:

• If the school does not provide a 100% refund – Ask your school about their refund policy.

• If the student has more than $1,000 of academic expenses – Even if the school provides a 100% refund for tuition, most do not refund academic fees or student housing costs.

• If the student or family is taking out a student loan – Student and parent loans must be repaid even if a student must take a medical withdrawal. Tuition insurance can be used to repay the balance of these loans.

“GradGuard’s tuition insurance provides affordable coverage up to 100% of the cost of college including student housing, tuition and academic charges,” said Fees. “In addition, each policy also includes Student Life Assistance that helps families through the logistics that may accompany an unexpected student withdrawal. ”

Despite the stress and changes caused by Coronavirus to higher education, the good news is that college families can protect both their student and their investment by purchasing GradGuard’s tuition insurance, with rates as low as $106 for $10,000 of tuition insurance coverage at participating schools. Coverage must be purchased prior to the first day of school.

“Students and their families can take confidence in schools that provide GradGuard’s insurance programs to help protect their investment in college and are prepared to overcome the unexpected events that may otherwise disrupt their semester,” said Fees.

About GradGuard: GradGuard is a technology-enabled pioneer in developing innovative protections designed to reduce the financial risks of college life. Since 2009, GradGuard is trusted by more than 400 colleges and universities and since its founding has protected nearly one million students and families. Visit GradGuard.com to use its college insurance search tool to find the insurance programs that are right for your college student or recommended by their college or university.

Contact:

Natalie Tarangioli

480-485-6138

ntarangioli@gradguard.com